How Many Taxpayers In South Africa . Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. Individuals who pay personal income tax and vat and corporates. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. Personal income tax contributes 35.5%, vat 25.0%. The sars statistics for 2022 show who pay the most tax: Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following:

from www.bericcroome.com

Personal income tax contributes 35.5%, vat 25.0%. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: The sars statistics for 2022 show who pay the most tax: Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Individuals who pay personal income tax and vat and corporates. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax.

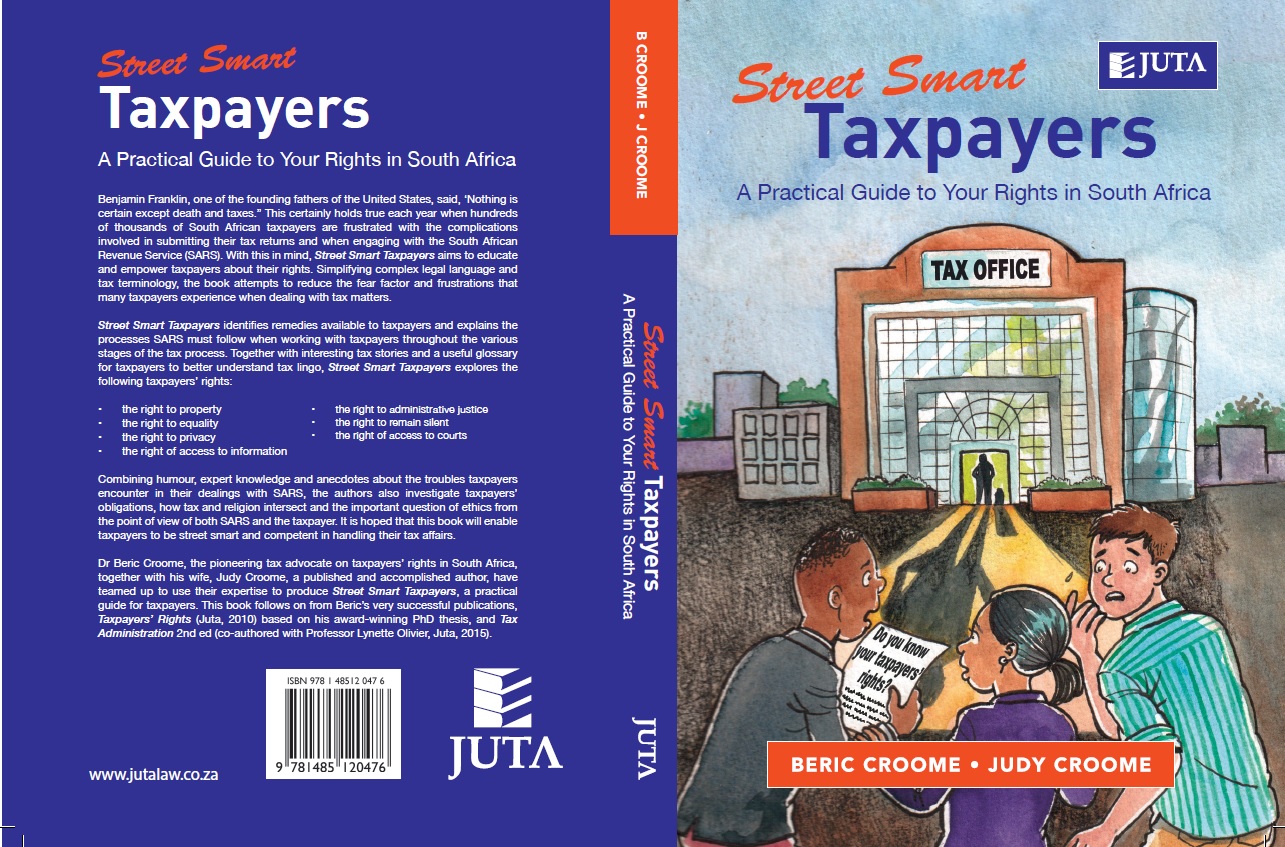

Dr Beric Croome Street Smart Taxpayers A Practical Guide to Your

How Many Taxpayers In South Africa On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. Individuals who pay personal income tax and vat and corporates. Personal income tax contributes 35.5%, vat 25.0%. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. The sars statistics for 2022 show who pay the most tax: Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following:

From www.sapeople.com

SARS Sets Up New Unit for Wealthy Taxpayers SAPeople Worldwide How Many Taxpayers In South Africa The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are. How Many Taxpayers In South Africa.

From businesstech.co.za

The highestpaid MPs in South Africa earn R226,400 a month BusinessTech How Many Taxpayers In South Africa Individuals who pay personal income tax and vat and corporates. Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. The sars statistics for 2022. How Many Taxpayers In South Africa.

From money101.co.za

Who pays tax in South Africa Money 101 How Many Taxpayers In South Africa Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. The sars statistics for 2022 show who pay the most tax: Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. Individuals who pay personal income tax and vat and corporates.. How Many Taxpayers In South Africa.

From entrepreneurhubsa.co.za

Taxpayers in South Africa need to play by the rules or else How Many Taxpayers In South Africa Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. The sars statistics for 2022 show who pay the most tax: Individuals who pay personal income tax and vat and corporates. The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. On 31. How Many Taxpayers In South Africa.

From kryptomoney.com

The Onus Is On Taxpayers To Declare All CryptocurrencyRelated Taxable How Many Taxpayers In South Africa Individuals who pay personal income tax and vat and corporates. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa,. How Many Taxpayers In South Africa.

From businesstech.co.za

SARS is now issuing this letter to taxpayers leaving South Africa How Many Taxpayers In South Africa On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Individuals who pay personal income tax and vat and corporates. Find annual tax statistics from sars and national treasury,. How Many Taxpayers In South Africa.

From businesstech.co.za

How the government spends every R100 of taxpayers’ money in South How Many Taxpayers In South Africa Individuals who pay personal income tax and vat and corporates. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. Only 17.9% of south african taxpayers earn over r500,000 a year,. How Many Taxpayers In South Africa.

From www.frontieram.co.za

It’s no longer just wealthy taxpayers who are leaving South Africa How Many Taxpayers In South Africa The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. Individuals who pay personal income tax and vat and corporates. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. Find annual tax statistics from sars. How Many Taxpayers In South Africa.

From www.researchgate.net

(PDF) Conceptual Framework For Classifying Government Imposts Relating How Many Taxpayers In South Africa The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. Individuals who pay personal income tax and vat and corporates. The sars statistics for 2022 show who pay the most tax: On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the. How Many Taxpayers In South Africa.

From www.youtube.com

What is the Taxpayers' Union of South Africa? YouTube How Many Taxpayers In South Africa The sars statistics for 2022 show who pay the most tax: Personal income tax contributes 35.5%, vat 25.0%. Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. On 31 march 2019,. How Many Taxpayers In South Africa.

From mybroadband.co.za

South African taxpayers milked dry How Many Taxpayers In South Africa Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: Individuals who pay personal income tax and vat and corporates. Find annual tax statistics from sars and national. How Many Taxpayers In South Africa.

From www.thesouthafrican.com

STERN message from SARS to taxpayers in South Africa How Many Taxpayers In South Africa Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. The south african revenue service (sars) has released its 2023 annual tax statistics, showing a r183 billion increase in gross tax. The sars statistics for 2022 show who pay the most tax: Individuals who pay personal income. How Many Taxpayers In South Africa.

From carleebkellyann.pages.dev

South African Tax Brackets 2024 Mamie Rozanna How Many Taxpayers In South Africa On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. The south. How Many Taxpayers In South Africa.

From www.rollingalpha.com

Who pays South Africa’s tax? The 2017 Edition Rolling Alpha How Many Taxpayers In South Africa Individuals who pay personal income tax and vat and corporates. Personal income tax contributes 35.5%, vat 25.0%. Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. The sars statistics for 2022 show who pay the most tax: Find annual tax statistics from sars and national treasury, including. How Many Taxpayers In South Africa.

From www.africa-press.net

This is how much it cost taxpayers to host the BRICS summit in South How Many Taxpayers In South Africa Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. The sars statistics for 2022 show who pay the most tax: On 31 march 2019, the tax register of sars had. How Many Taxpayers In South Africa.

From www.sapeople.com

VIP bluelight brigades How much is it costing South African taxpayers How Many Taxpayers In South Africa The sars statistics for 2022 show who pay the most tax: Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. Only 17.9% of south african taxpayers earn over r500,000 a year, but make up 52% of all taxable income in the country. Pwc estimates that 1.6 million people pay 80% of personal income. How Many Taxpayers In South Africa.

From businesstech.co.za

Warning for taxpayers in South Africa BusinessTech How Many Taxpayers In South Africa Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. The sars statistics for 2022 show who pay the most tax: Pwc estimates that 1.6 million people pay 80% of personal income tax in south africa, while corporate tax revenues are volatile and high. The south african revenue service (sars) has released its 2023. How Many Taxpayers In South Africa.

From www.moneyweb.co.za

tax This is what you’ll pay Moneyweb How Many Taxpayers In South Africa The sars statistics for 2022 show who pay the most tax: Find annual tax statistics from sars and national treasury, including revenue collections, personal income tax, company. On 31 march 2019, the tax register of sars had in excess of 26 million entries, excluding the following: The south african revenue service (sars) has released its 2023 annual tax statistics, showing. How Many Taxpayers In South Africa.